This article originally appeared in the Omdia blog.

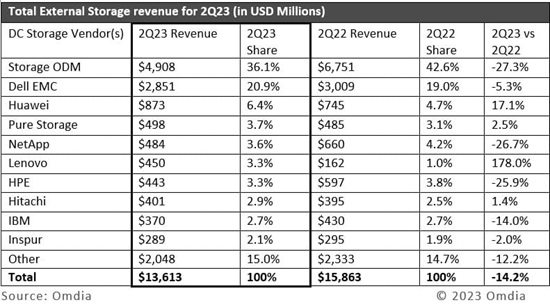

According to the Omdia Data Center storage tracker, total revenue for data center storage external systems decreased 14.2% year-over-year (YoY) to $13.6 billion and quarter-over-quarter (QoQ) increased 1.8% in the second quarter of 2023 (2Q23), offering a sequential boost but falling short of the usual QoQ seasonality increase.

A slowdown in data center storage demand has a broad impact on both enterprise or traditional storage system manufacturers and ODM equipment providers, as seen by the data center storage revenue chart below. Enterprise storage equipment vendors saw a decline in demand from levels seen last year as enterprise purchasers have slowed acquisitions and postponed big-ticket storage purchases again in the second quarter of this year. The ODM vendor group, which primarily manufactures and ships storage to the biggest cloud service providers (CSPs), has been particularly impacted as CSP services revenues have slowed. CSPs now appear to be adopting new equipment with a lot more caution after numerous years of very high storage shipment growth.

Revenue generated by ODM direct from shipping white box storage (aka dense storage-servers and server expansion) to mostly hyperscale CSPs decreased by 27.3% YoY in 2Q23 to $4.9 billion. Storage shipped by enterprise vendors overall decreased 4.5% to $8.7 billion in 2Q23 but did register a sequential increase of 8%, thus providing some hope for continued shipment growth for enterprise vendors through the second half of 2023.

What has happened to cloud growth is the key question for 2023. The late 2022 growth downturn we are still in seems to have been brought on by a number of economic factors, including global economic headwinds, cautious storage deployment to control costs, and the need to exhaust equipment stocks that had been built up to stabilize supply chains.

IT planners have also been busy rebalancing workloads to best manage their storage costs. This workload reconciliation has resulted in repatriation of some applications back to on-premises data centers. There is also convincing evidence that several CSPs have heavily altered their expenditure priorities towards investing substantially in GPUs rather than storage. Given the current 2023 dash towards greater GPU adoption, it is difficult to know when this shift will normalize or reverse, but eventually more storage in support of these GPUs will be required.

Enterprise vendor external storage results, by company

- The group of ODMs working directly with cloud infrastructure buyers to provide white box storage dropped over 6.5 percentage points in share, accounting for 36.1% of market revenue.

- Dell EMC, the largest single vendor in the storage market with 21% of total revenue, took back over 2 points from the same quarter last year.

- Huawei ranked third in vendor revenue, even in the face of difficult economic conditions in China, with 6.4% share and being one of the market's bright spots with a 17% YoY increase.

- Lenovo continued to do well in the rankings, improving over 2 points in revenue share and registering a storage increase of 178% YoY in 2Q23 (excludes HCI). Much of its growth is due to gaining new hyperscaler CSP storage customers as a part of its “ODM plus” strategy.

The Accelerated Buildout of Cloud Infrastructure Services Is Slowing

The market for cloud services is entering maturity and the largest CSPs (AWS, Microsoft, Google) have shifted their focus to optimization and cost saving. Even though it has matured, the market for cloud storage services is still anticipated to thrive, but growth will inevitably slowdown from its previously high growth stages. According to Omdia's analysis of the market, global cloud services experienced a 26% CAGR from 2018 to 2023; going forward, we anticipate a much lower 10% plus CAGR over the next five years for overall cloud services which includes storage.

The storage that is most suitable for the cloud and was easily transportable has already been moved to the cloud. Over the past few years of heavy cloud usage, customers have discovered that some storage workloads are not as well suited for the cloud and can be expensive to run in that environment, which has helped fuel the expansion of on-premises storage again. Although AI and massive language models have a significant upside potential to drive more storage, it is still too early to say how much they will affect storage growth. Omdia continues to think that because storage and data management are strategic components of modern digital enterprises, they will continue to make long-term investments in storage for at least our forecast horizon.

Omdia predicts below average 2023 annual data center storage revenue growth decline of 11% YoY, held up by a projected an enterprise market growth uptick occurring in the second half. Omdia expects the current economic outlook to improve in 2H23, and boost traditional enterprise storage higher, but this boost will not offset the relatively weak first half 2023 in full year results. Omdia anticipates that CSP storage will start to recover in late 2023 but is unlikely to see a full recovery until 2024. Cloud demand will recover, but due to its cost optimization focus and the elasticity of its storage capacity in the face of lower services demand, it will take at least a year’s time span to return to strong growth.

.png)